On this article I want to give out a guide on How to fundraise from Sequoia Capital. DISCLAIMER: This article is based only on my own research and I have no affiliation with Sequoia Capital).

You’ll find:

- Introduction Sequoia Capital and Don Valentine

- How Sequoia Invests: what founders and markets they look for Premium

- How to contact Sequoia Capital (and who)

Now, I wasn’t going to let you start reading without some good beats.

Introduction

Sequoia Capital is likely not to need an introduction, but I think there’s still a lot we can learn from it.

Sequoia is one of the most mythical Silicon Valley venture capital funds, founded 1972 by Don Valentine in Menlo Park, California.

It is known for early investments in iconic companies like Apple, Google, WhatsApp, Airbnb, and Zoom, Sequoia has significantly shaped Silicon Valley.

Don Valentine, the founder of Sequoia Capital, is also one of the people that shaped the Venture Capital Industry.

He began his career as a sales engineer at Raytheon before moving to Fairchild Semiconductor and then National Semiconductor, where he built a strong foundation in technology sales and marketing. This experience in the semiconductor industry was pivotal, providing him with insights into emerging technologies and the dynamics of tech markets.

Valentine's transition to venture capital was driven by his vision to invest in small, high-potential tech companies.

In 1972, leveraging his industry knowledge and strategic foresight, he founded Sequoia Capital in Menlo Park, California. Unlike many venture capitalists of his time who focused on the technology or the entrepreneur, Valentine emphasized the importance of market size and potential.

His approach was to invest in markets so large that even mediocre management couldn't get in the way of success, though he often bet on exceptional teams.

Valentine did not come from significant wealth; instead, he built his success through his strategic investments.

His early bets on companies like Atari and Apple were made possible through Sequoia’s initial $3 million fund. His ability to identify and support transformative companies helped shape Silicon Valley, and his legacy includes pioneering investments in Apple, Google, WhatsApp, Airbnb, and Cisco

There is so much to learn from Don, check this out when you have time.

How Sequoia Invests

- Stage Diversity: Sequoia Capital invests across all stages, from seed to late-stage, although most of their investments are in early stage.

- Investment Size: They are capable of making both smaller early-stage investments and large late-stage investments. They Typically use partial funding.

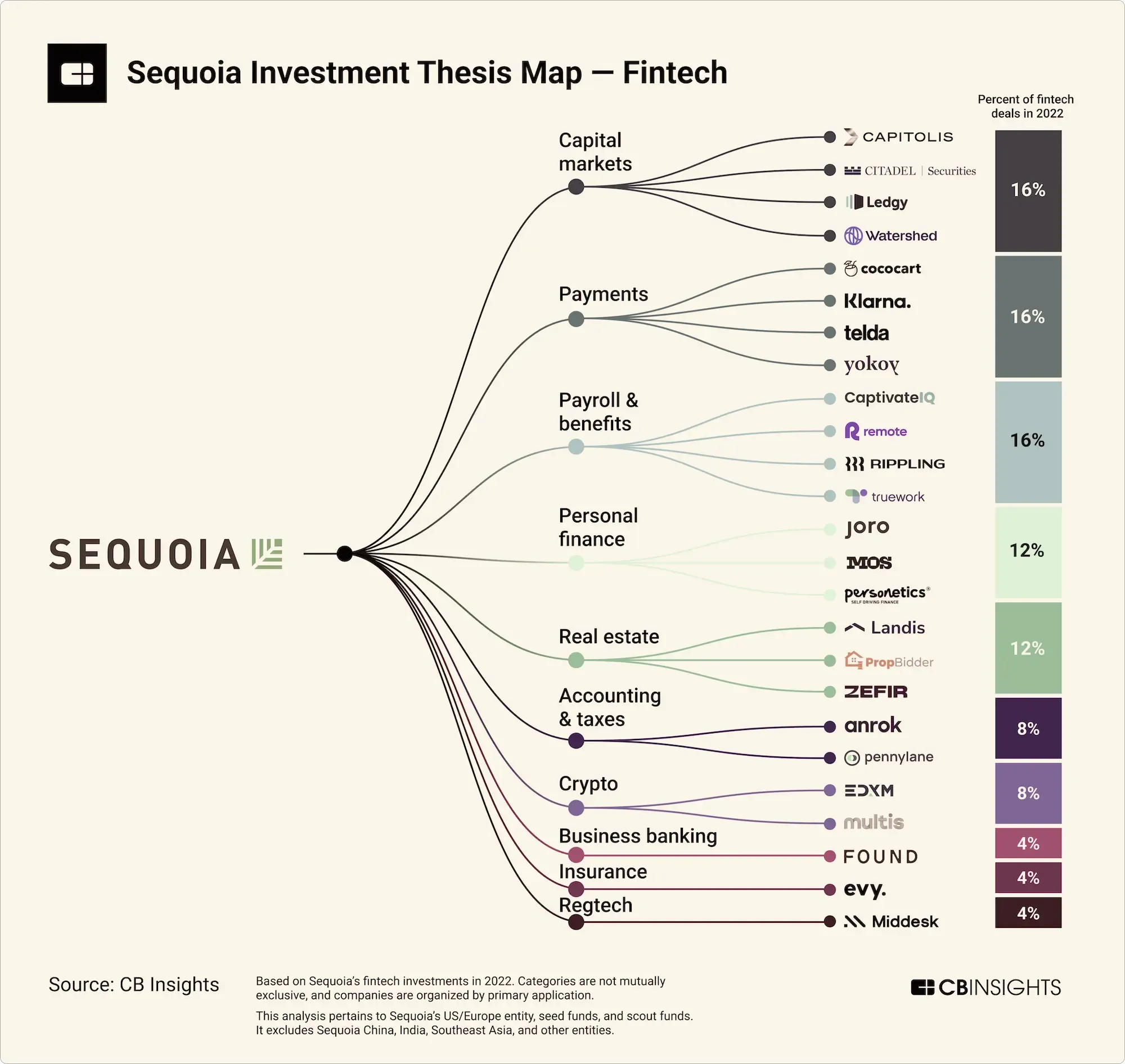

- Sector Focus: There is a clear emphasis on software, AI, healthcare, fintech, and enterprise software, aligning with current market trends and future growth potential.

- Speed to invest: fast and efficient as possible. We are happy to work with SAFEs or convertible notes. We typically do not take board seats.

"We’ve always partnered early. While we partner with companies at all stages, we have always preferred to be involved at the very beginning, when the odds of success seem slim, when much is hazy, and when founders need long-term allies" – Mike Vernal.

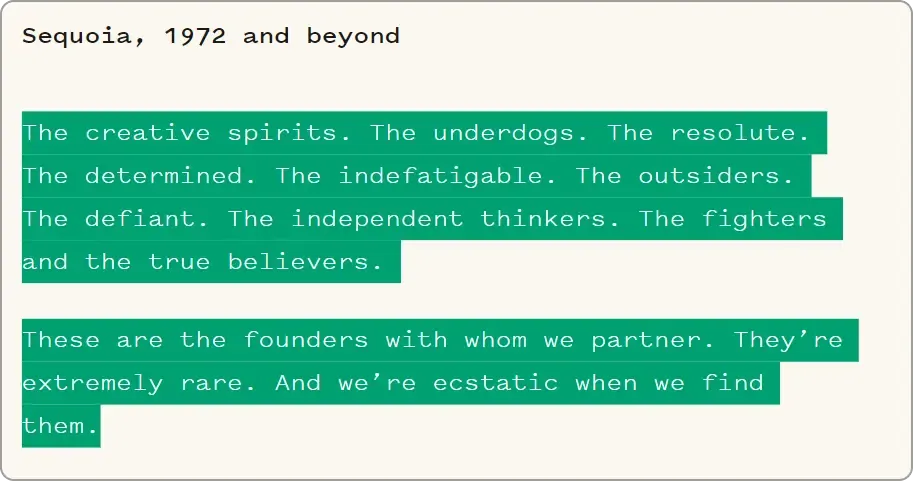

What are the profiles of the founders that are being funded by Sequoia?

Now, what does that truly mean?

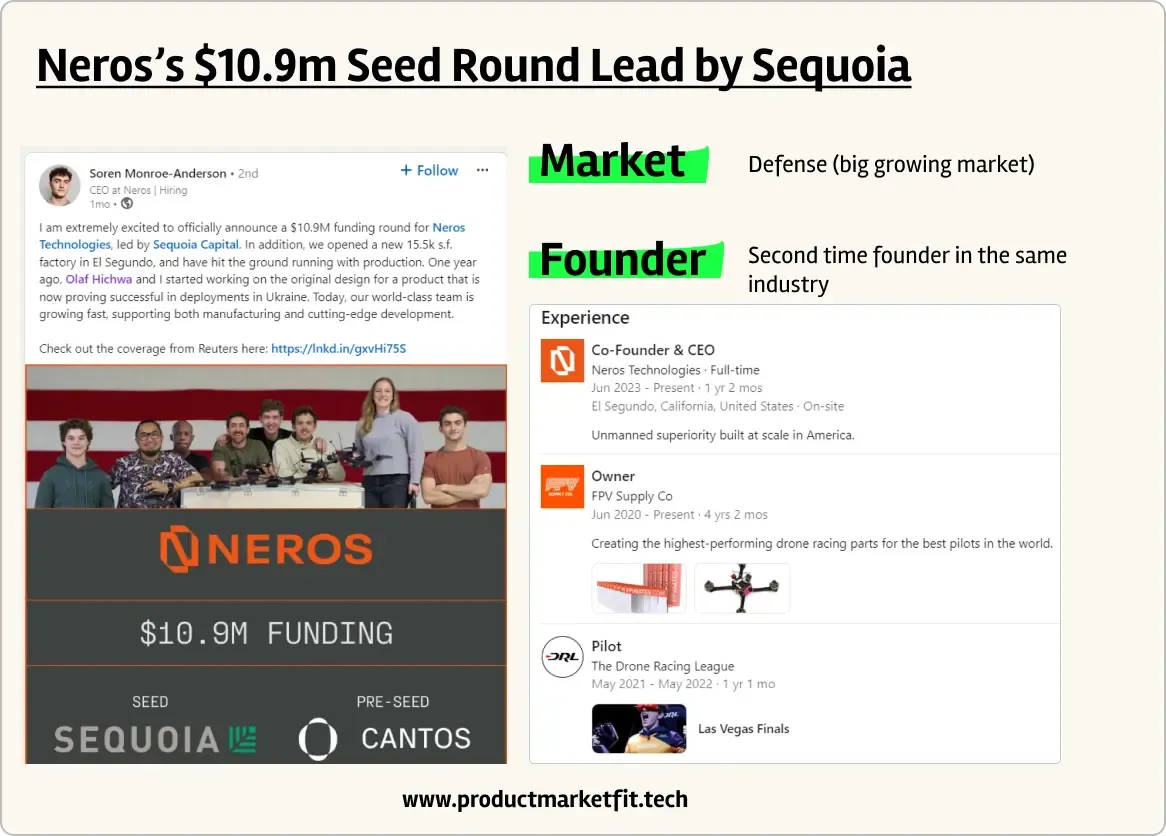

Fore Nero’s Seed round, it meant a founder that had a great expertise in the industry because of having built a company in that space before.

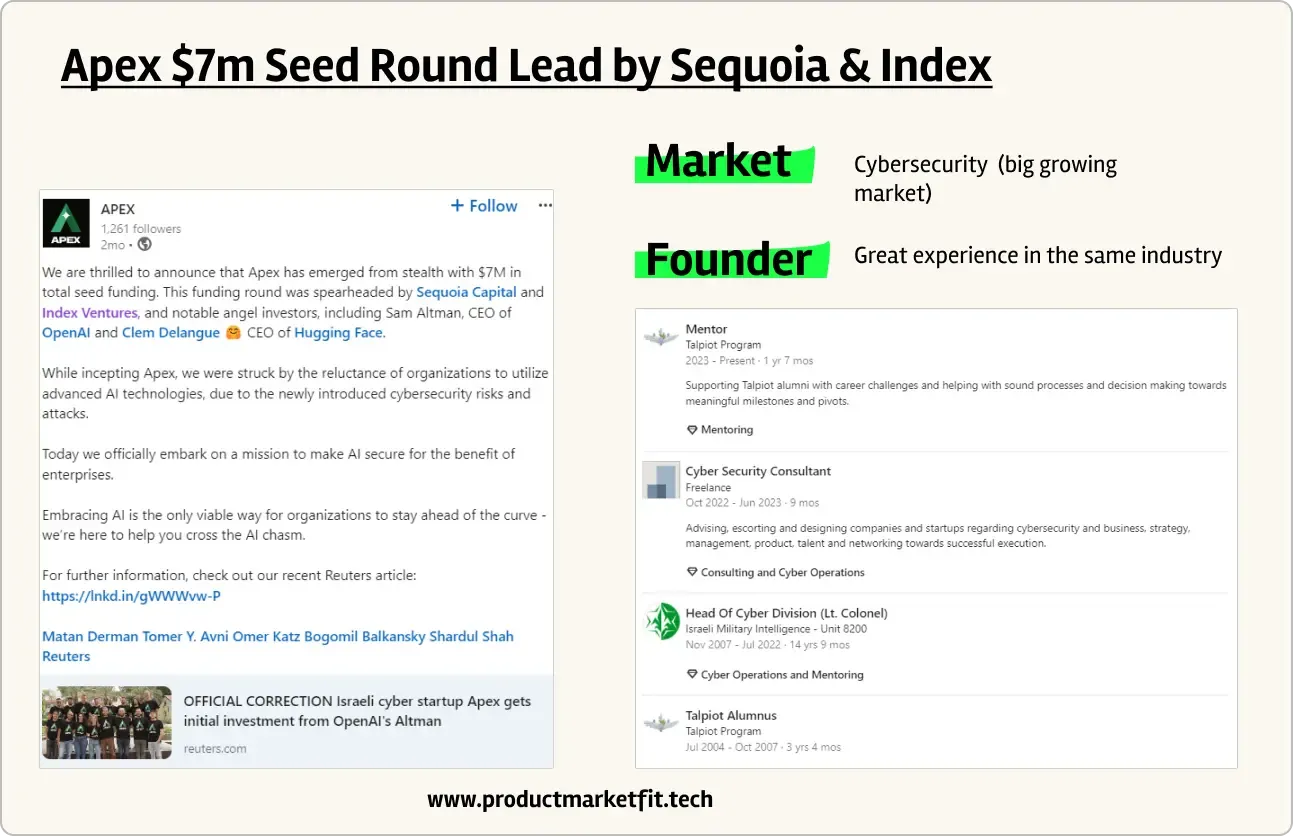

For APEX’s Seed Round, it meant investing in a founder that had proven to be exceptional in that industry as well (in this case cybersecurity).

Matan Derman, the founder, previously worked at Israeli Military Intelligence - Unit 8200 as a Head Of Cyber Division and had graduated from Stanford University Graduate School of Business.

What are the markets Sequoia is more active investing?

“We’re never interested in creating markets – it’s too expensive. We’re interested in exploiting markets early.” – Don Valentine

When Sequoia invests in an idea, they focus on how it will perform in growing markets, not just on a person’s background or intelligence. They look at the market size, competition, and existing customers to push the product without creating new markets.

Sequoia prefers large markets with ready customers, introducing innovative solutions rather than starting from scratch. They also move quickly into new markets. For example, their investment in Medallia shows how they target new solutions in established markets with existing customers.

Now, Sequoia analizes the market regularilly to find the biggest, fastest growing markets.

How to contact Sequoia Capital

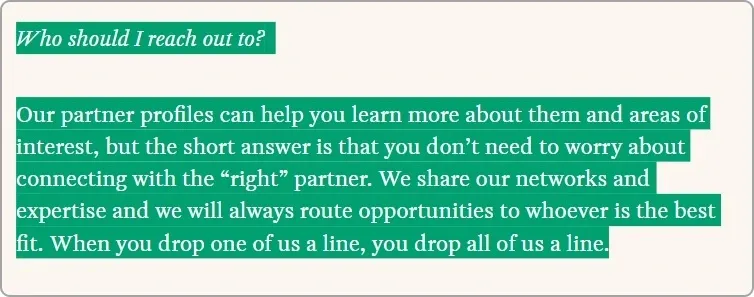

Option 1: Reach out to partner profiles through Linkedin

% of success: 10%

It can be a good option if your startup is very industry specific and you see one of the partners at Sequoia has great expertise in that industry.

However, partners at Sequoia receive thousands of cold connections so it can be hard to get a response back.

Option 2: Cold email

% of success: 0.5%

Although Sequoia leaves that email in its website to reach out to, it is highly unlikely they answer it.

Option 3: Find the way to meet them in person

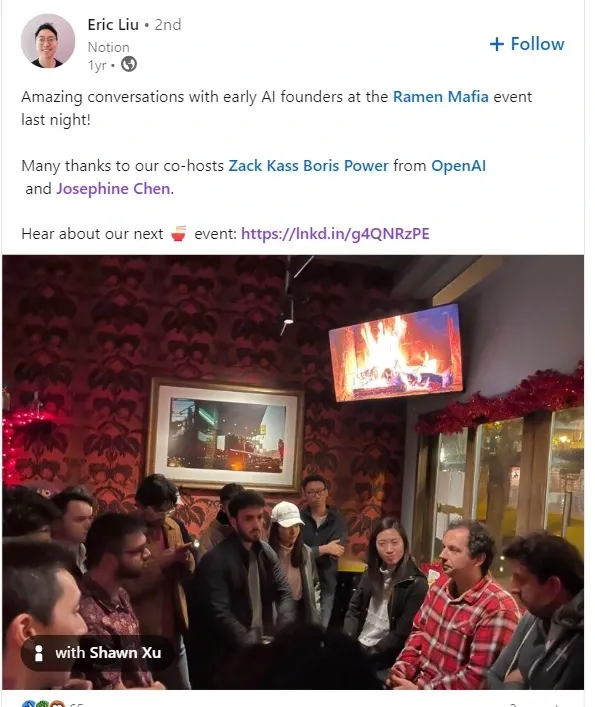

So, VCs go to many events to network and meet founders. The best way to meet them is to do your due diligence and find out where they are going to be hanging around.

For example, Sequoia’s partner Josephine Chen (and many other interesting people) are doing some meet ups in SF called Ramen Mafia.

You can apply here to join the community: https://airtable.com/appYJaWwxiPDoMsK7/shrADvnV6o0Zx0pTP

% of success: 60%

Option 4: Find someone that can introduce you

As Paul Cohn explains and Mike Vernal agrees, finding someone from Sequoia’s network to introduce you is the best way to contact with them.

% of success: 90%

Originally published on Product Market Fit