In the modern world, AI-powered systems are increasingly transforming industries, and FinTech is at the forefront of this change. As a Product Manager, I've seen how new technology made our old prioritisation methodology feels nearly rudimentary. That was a starting point of my journey about: how product managers could use AI to improve the prioritisation process. The research and testing led me to the concept of dual prioritization by implementing AI, which is inspired by the dual transformation framework.

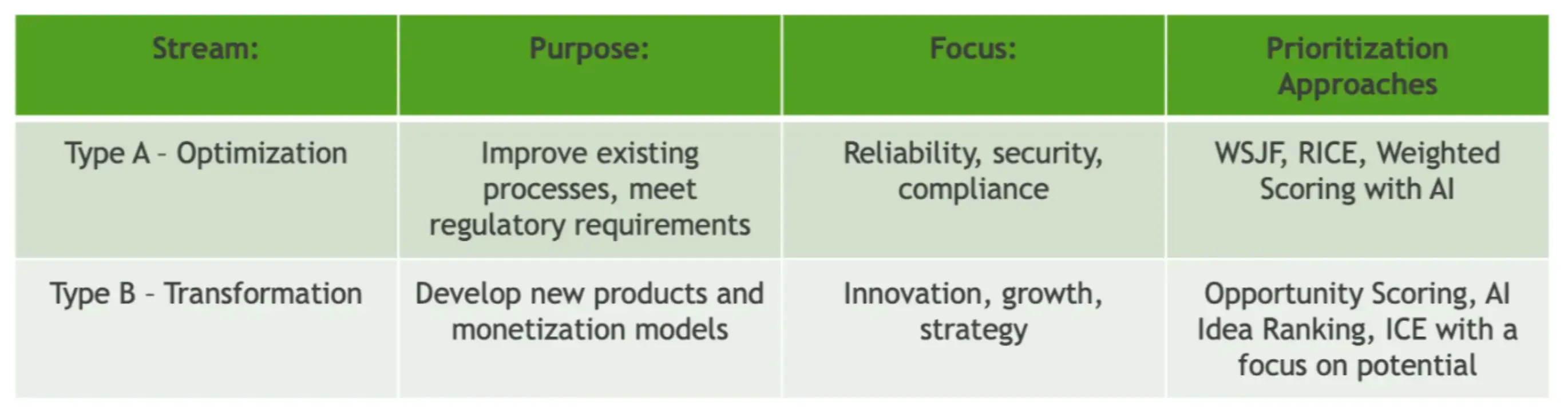

This method divides our roadmap into two equally important streams, which allows us to combine both stability and innovation.

Table 1. Dual Prioritization: Stability and Innovation

Keeping the streams separate helps to ensure that urgent compliance work doesn’t overshadow innovation, which is a common and well-known issue, when files are kept in a single backlog.

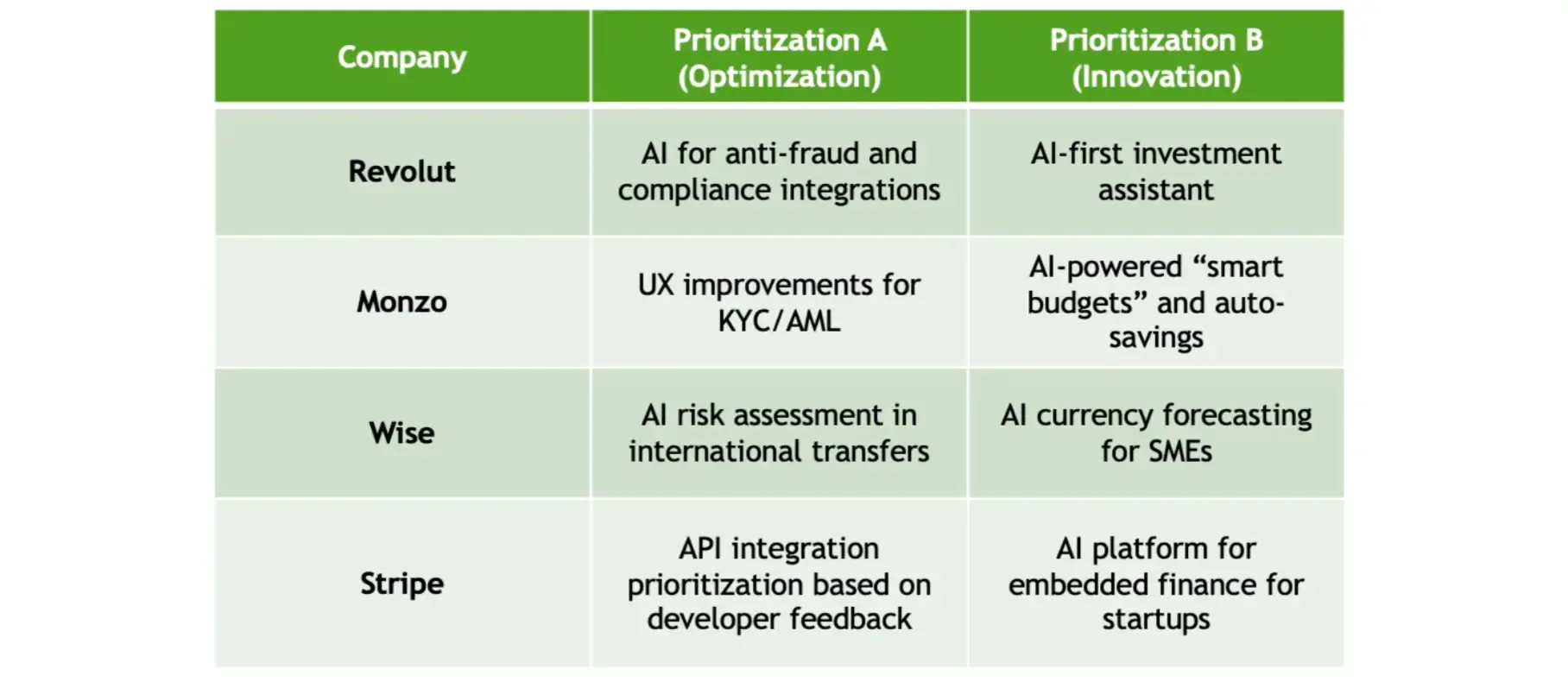

How FinTech companies already implemented AI

Let’s see the example how several fintech leaders are adopting dual-prioritisation model with AI integration:

Revolut

Optimization: Revolut uses AI in their analysis systems to detect and prevent fraud activities, which allows the system to be more automated, reduces the level of manual testing, decreases the client verification time, while tackling the money laundering processes.

Innovation: At the same time, the company focuses the efforts on developing an AI-powered investment assistant. It will provide investment advice based on the customer's portfolio and preferred type of investment.

Monzo

Optimization: Monzo is one of fintech pioneers in enhancing KYC/AML systems with AI solutions. This allowed the company to increase the customer retention rate, providing modern-level anti money laudering systems and staying in the avant-garde of secure banking policies.

Innovation: The company also uses AI to provide intelligent savings and smart budgeting services by analysing customer engagement and potential revenue rates to provide high-value advice.

Wise

Optimization: Wise utilises AI to discover fraud in international money transfers that provides better analytics, higher accuracy and decreasing false alarms, improving customer experience and operations.

Innovation: Wise is implementing an AI-powered currency forecasting tool to assist customers to analyse financial risks.

Stripe

Optimization: Stripe implements AI to analyze Engineers’ feedback, which helps them prioritize and make important improvements to their APIs and security.

Innovation: Also, Stripe suggests an AI-powered finance analytics platform, which assists startups adding financial services to their products. The company uses AI to analyze business potential and user feedback to make a decision on which functionalities to prioritise first.

Case Study: Applying Machine Learning for Alerting Systems Optimization

After researching several applications of AI in prioritization, I decided to test one of its most practical implementations — machine learning-driven prioritization for alerting systems optimization.

The product was focused on monitoring infrastructure that generated hundreds of alerts across different environments each day. The operations team was overwhelmed by the number of tickers that led to increased MTTR and delayed responses to the tickets. This in sum caused an increased level of users’ dissatisfaction.

To summarise the list of items to improve:

- The overwhelmed number of alerts impacted the ability to identify critical issues quickly

- Many alerts were false positives or low-priority but consumed sufficient amount of valuable engineering time

- Manual investigation was inconsistent and required additional time efforts leading to operational risks increasing and operative responses delaying

So that there was a clear need to improve alert prioritization to reduce false positives and low-priority alerts and speed up incident resolution.

As a Product Manager, I initiated the integration of machine learning into the alert management process to assist in improving prioritization and operational efficiency by conducting the 5 steps approach.

1. Initiating a discovery and scoping phase:

- Facilitated the discovery workshop with operations and engineering teams

- Defined our goals: cut down false positive alerts, review the alerts threshold rates, speed up incident response, and improve overall operational visibility

- Created a prioritized backlog of user pain points and hypotheses for improvement

2. Implementing a delivery roadmap

- Created several prototypes of machine learning alert classification using historical data and pilot testing on a small site

- Analysed and reviewed the alerts threshold rate

- Prioritized features based on feedback loops and measurable impact on alert volumes and MTTR.

3. Integrating machine learning prioritization into new workflows

- Develop models based on historical alert severity and corresponded business metrics

- Integrated machine learning in alert scoring system into our incident management tool. As a result, every alert comes with priority flags and suggested response steps

- Agreed to automatically send all high risk alerts for manual human check to maintain proper quality and compliance check.

4. Support continuous feedback and visibility

- Updated dashboards that displayed real-time alert metrics, response times, and system health for all teams.

- Conducted regular retrospectives and data analysis reviews to adapt models to support a continuous improvement culture

- Conducted training to teams to adopt a new dashboard confidently and support continuous feedback loop

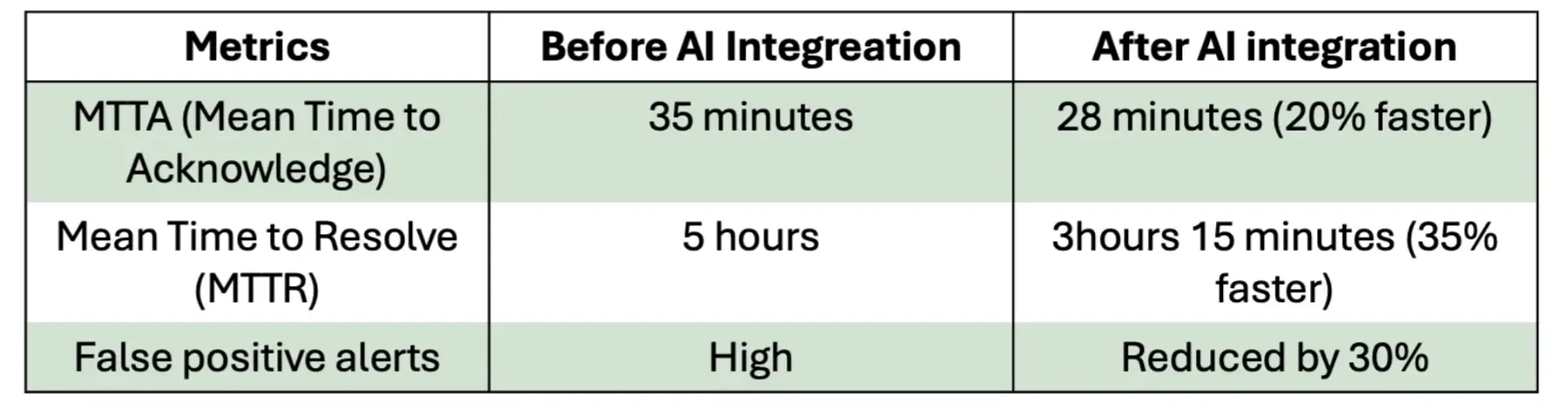

Results

The reduction in the number of false positive alerts by over 30% allowed teams to focus on supporting the priority incidents rather than constantly handling the emergency situation. The 35% decrease in MTTR and a 20% decrease in MTTA had a lead role in the operational stability. Human control support provided balance in compliance and trust to the machine learning decisions. Stronger collaboration and shared sense of ownership across teams led to fine-tuning of our processes.

Conclusion

Dual prioritization with AI support is already a new trend in fintech companies aiming to stay competitive. It balances regulatory responsiveness, optimisation, improves decision quality, and creates a place to innovate.

However here are some risks to consider:

- Model errors and bias especially with limited data

- Humans check necessity at critical stages.

- Trustworthy of the AI decisions to regulators

- Dependency in quality and completeness of data

- Legal concerns that come with AI implementation

Creating the balance between technology and human control could minimize these risks and bring the most benefit from applying AI in prioritisation. If you already use AI in requirements prioritisation, share your experience with me so we can work together toward better solutions.

Resources:

- https://www.rishabhsoft.com/blog/generative-ai-in-banking

- https://www.revolut.com/news/revolut_launches_ai_feature_to_protect_customers_from_card_scams_and_break_the_scammers_spell/

- https://www.retailbankerinternational.com/news/revolut-2025-plans-ai-assistant-digital-mortgages/?cf-view

- https://www.bloomberg.com/news/videos/2025-06-17/revolut-to-launch-ai-financial-assistant-uk-ceo-video

- https://youverify.co/blog/kyc-aml-compliance-monzo-bank

- https://www.thoughtworks.com/en-gb/insights/blog/data-strategy/monzo-fine-teach-navigating-growth-financial-services

- https://tbtech.co/innovativetech/artificial-intelligence/monzo-how-the-bank-of-the-future-uses-ai/

- https://community.monzo.com/t/nova-money-planner-q-a/122454

- https://wise.com/gb/blog/ai-for-global-payments

- https://wise.com/us/blog/business-fx-payments

- https://stripe.com/sessions/2025/applied-ai-delivering-on-growth

- https://stripe.com/gb/payments/ai